Condo Insurance in and around Omaha

Unlock great condo insurance in Omaha

State Farm can help you with condo insurance

Calling All Condo Unitowners!

Life happens.. Whether damage from weight of snow, smoke, or other causes, State Farm has excellent options to help you protect your condominium and personal property inside against unpredictable circumstances.

Unlock great condo insurance in Omaha

State Farm can help you with condo insurance

Condo Unitowners Insurance You Can Count On

Despite the possibility of the unpredictable, the future looks bright when you have the dependable coverage that Condo Unitowners Insurance with State Farm provides. More than just protection for your condominium and personal property inside, you'll also want to check out bundling possible discounts, and more! Agent Matt Rowe can help you develop a Personal Price Plan® based on your needs.

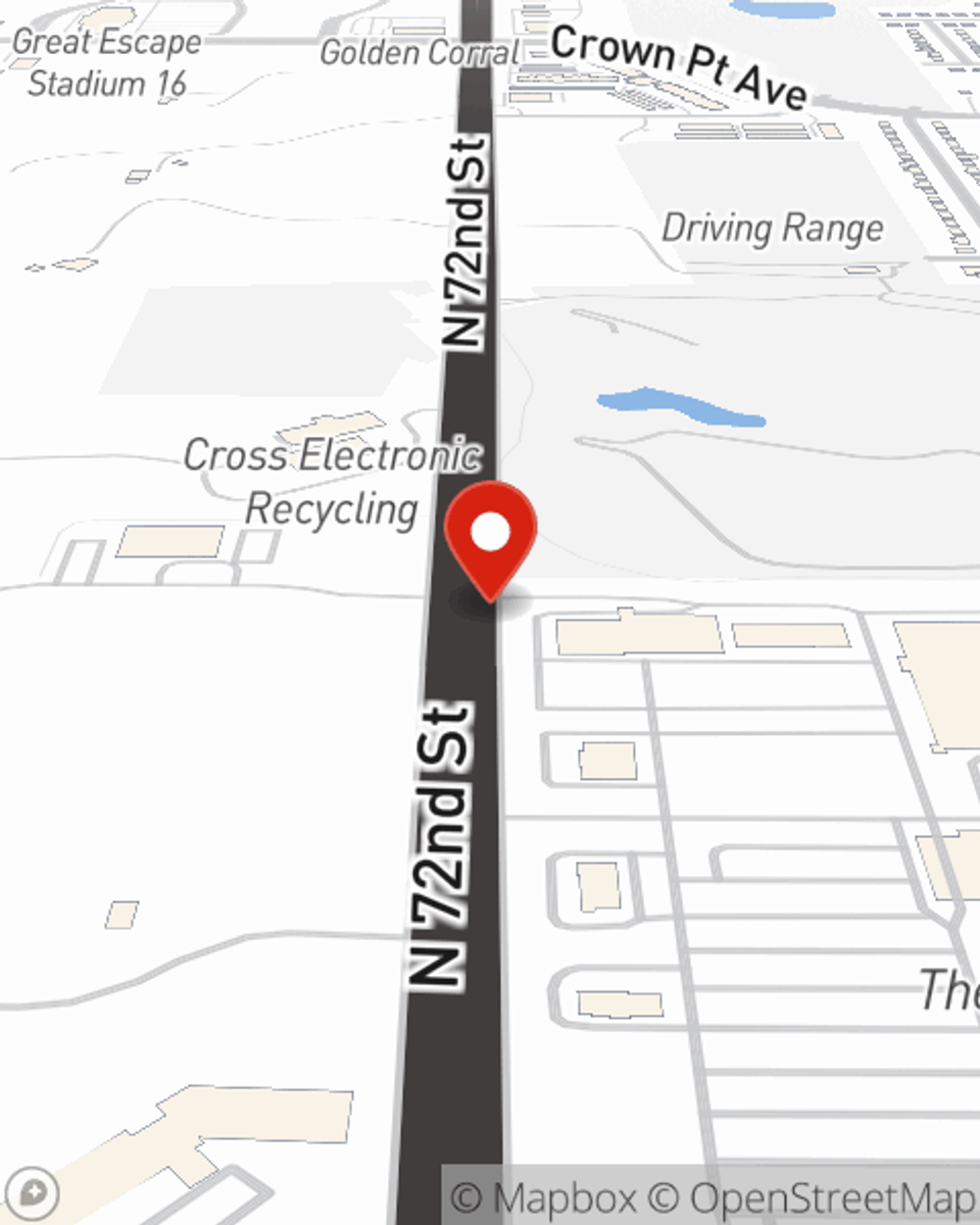

Get in touch with State Farm Agent Matt Rowe today to check out how one of the well known names for condo unitowners insurance can help protect your condo here in Omaha, NE.

Have More Questions About Condo Unitowners Insurance?

Call Matt at (402) 933-1181 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.