Business Insurance in and around Omaha

One of the top small business insurance companies in Omaha, and beyond.

Helping insure businesses can be the neighborly thing to do

Business Insurance At A Great Price!

Operating your small business takes time, hard work, and great insurance. That's why State Farm offers coverage options like a surety or fidelity bond, extra liability coverage, errors and omissions liability, and more!

One of the top small business insurance companies in Omaha, and beyond.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

Whether you own cosmetic store, a donut shop or an arts and crafts store, State Farm is here to help. Aside from fantastic service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

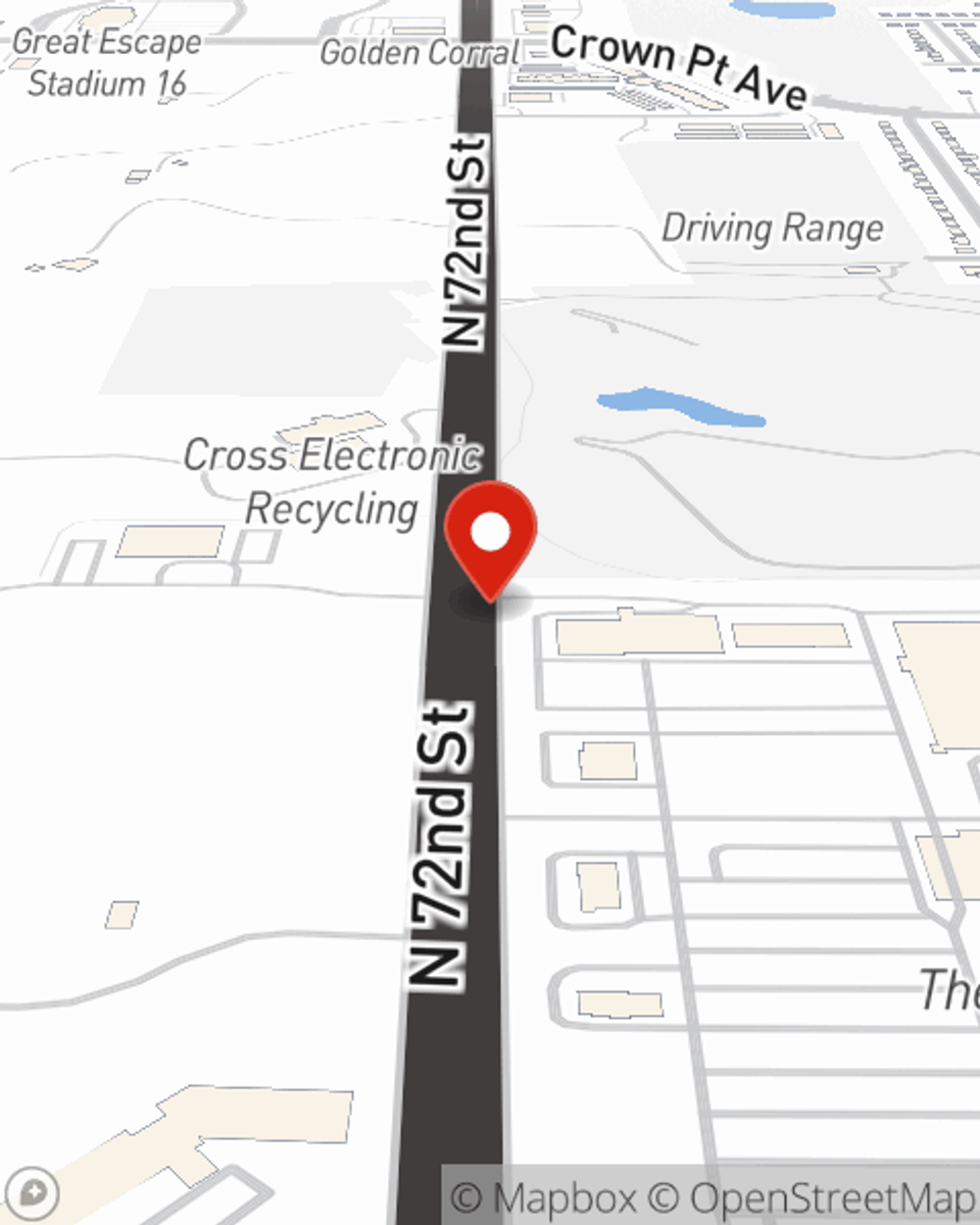

Agent Matt Rowe is here to talk through your business insurance options with you. Visit with Matt Rowe today!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Matt Rowe

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.